The Treasury of Merit: How the Catholic Church Invented the Spiritual Economy

Before credit cards and carbon offsets, there was a system that treated virtue like currency. In the Middle Ages, the Catholic Church built what might be called the first financial infrastructure of the soul: the treasury of merit. It was a cosmic account, stocked with the infinite goodness of Christ and the surplus virtues of the saints. From that vault, the pope could draw to forgive sin, shorten a penitent’s time in purgatory, or even transfer grace to the dead.

The logic was economic before economics existed. Salvation became a matter of credit—an invisible currency measured in faith, confession, and donation. What began as theology evolved into bureaucracy. The Church had not only organized heaven but monetized it.

The Invention of Moral Credit

The early Church treated forgiveness as a sacrament. By the eleventh century, it had also become a system of exchange. Christ’s suffering, theologians argued, was infinite; its value could cover humanity’s debt. Saints, through their excess virtue, added to the account. The pope, holding the keys of Peter, administered the transfer.

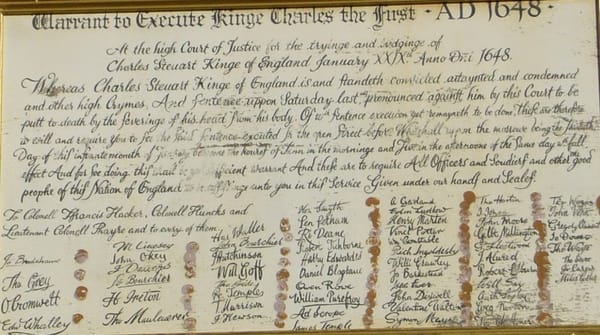

Thus indulgences were born—initially symbolic remissions of penance, later literal certificates of salvation. To modern eyes, it resembles the first ledger of moral finance. Where Florence and Venice built banks of gold, Rome built one of grace.

Relics, Pilgrimage, and the First Franchises

By the High Middle Ages, every cathedral became a branch office of heaven. Relics served as local currency: a saint’s finger bone, a vial of martyr’s blood, a splinter from the True Cross. Pilgrimage routes formed the arteries of this sacred economy, drawing travelers—and their coins—toward miracle markets in Santiago de Compostela, Canterbury, and Rome.

Souvenirs were receipts of salvation. Miracles functioned as advertising. Faith moved along supply chains long before global trade. The Church didn’t just export doctrine—it exported holiness as a commodity.

The Indulgence Bubble

By the fifteenth century, grace had gone retail. When Pope Leo X sought funds to complete St. Peter’s Basilica, he authorized a continent-wide sale of indulgences. Dominican friar Johann Tetzel toured Germany preaching, “As soon as the coin in the coffer rings, the soul from purgatory springs.”

The scheme worked—until it didn’t. In 1517, Martin Luther nailed his Ninety-Five Theses to a church door in Wittenberg, denouncing indulgences as counterfeit currency. The Reformation that followed was, in part, a market correction: faith deflating after centuries of speculation. Where bankers had tulips, the Church had time off purgatory.

Globalizing Grace

Rome adapted. Instead of collapsing, it diversified. The Counter-Reformation standardized the canonization process, turning saints into a renewable moral resource. Centuries later, John Paul II would canonize more than four hundred people—more than any pope in history.

Each new saint extended the Church’s brand into new territories: Guadalupe for Mexico, Tekakwitha for Indigenous America, and a host of African, Asian, and Eastern European figures for a global flock. The Vatican learned what every corporation would later discover—that identity could scale.

The Economics of Eternity

The parallels to finance were more than metaphor. Donations became investments; relics, high-value collectibles; pilgrimages, experiential markets. Even the Vatican Bank, founded in 1942, carried the same spiritual DNA—balancing invisible faith with visible assets.

If John Maynard Keynes invented fiscal stimulus, the popes had pioneered moral stimulus centuries earlier. When devotion waned, they printed more grace. Like any central bank, the Church inflated supply to preserve belief.

The Collapse of Faith Capital

But moral credit, like economic credit, depends on trust. The twentieth century’s abuse scandals and financial cover-ups eroded the Church’s credibility faster than any Protestant tract. Pilgrimages became tourism. Donations looked like bribes. Even miracles required better marketing.

John Paul II’s stadium masses and Francis’s global tours functioned like IPOs for faith—public roadshows to reassure investors that the product still held value. The crowds came, but the metrics never recovered. A system built on grace was now surviving on reputation.

The Holiness Index

Both money and morality rest on belief in the unseen. A currency works only if people agree it’s real; a religion survives only if the faithful agree the system still redeems. The treasury of merit may have vanished, but its structure persists everywhere—from carbon credits to social-media virtue points.

Sociologist Max Weber once wrote, “The spirit of capitalism was born of religious ethics.” The Church proved it first. It created the prototype for markets of trust, long before markets were secular. If salvation was once the coin of Christendom, today it’s the algorithm’s. And somewhere, perhaps still, a celestial accountant is balancing the books.